Aggregators Are Watching – It’s Time to Optimize Your Amazon Listing

Experts say that Amazon sellers should always have their brand ready to sell. Aggregators are watching AND it’s just good business!

There’s No End In Sight for Ecommerce Sellers

Business success has a way of creating positive inertia on its own. It’s like pushing a car that’s run out of gas. Once you have it moving forward, it’s much easier to keep it going.

The exponential growth of ecommerce in the last year has helped create large numbers of successful Amazon sellers. Though there have been struggles with inventory because of the pandemic and supply chain crisis, ecommerce business has been very good.

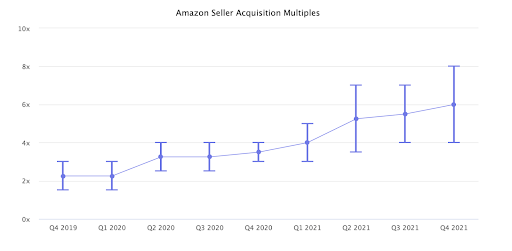

The single best way to highlight this trend is in the rapid growth of Amazon business valuations.

Amazon Business Valuations Have Doubled Since 2020

It’s simple. Amazon business valuations have skyrocketed since the start of 2020.

A year ago, the thought of selling an Amazon business wasn’t on an online seller’s radar. In fact, Business Insider recently wrote that Thrasio’s Vice President of Acquisitions, Ken Kubec said to an audience at a recent webinar, “We were Googling, ‘How do you buy an Amazon business?’ and there was nothing on the internet about it.”

It seems that no one, particularly investors, understood Amazon businesses. Now, the marketplace is catching up in a hurry.

According to Marketplace Pulse research, Amazon private label sellers are being acquired for multiples of 4X to 8X (before interest, taxes, depreciation, and amortization), plus potential earn-outs that could bring the total to 10 times their valuation.

Back at the beginning of 2020, average valuations ranged from 2.5 to 3X.

Marketplace Pulse goes on to say that “Amazon sellers typically are acquired for multiples of Seller’s Discretionary Earnings (SDE), a form of Adjusted EBDITA (earnings before interest, taxes, depreciation, and amortization).” In other words, a rough analysis of their annual net profit.

For example, a business with $1 million in revenue and $250,000 in SDE profit would typically receive offers of more than $1 million guaranteed payment (4x the SDE) plus earn-out payments.

Aggregators Have Their Foot on the Ecommerce Gas Pedal

Ecommerce sellers that have spent any time at all on social media, conferences or meetups know that in the last year, Amazon aggregators have become a large part of the conversation.

That’s why it’s not a surprise to many that ecommerce aggregators, particularly those that specialize in buying up Amazon sellers, are by far the most active buyers of Amazon businesses. In 2021 alone, the 87 active Amazon aggregators have raised more than $12 billion in funding with super-star aggregator Thrasio leading the list with a total of $3.4 billion and more than 200 brands under its control.

In a recent CrunchBase article, Carlos Cashman, co-founder and CEO of Thrasio said, “No question, there’s a tremendous investor appetite for aggregators right now. We have uncovered a space that is huge—the change of consumer hard goods from a physical, locational-driven model to a digital-first, non-locational future. We’re talking about at least $4 trillion to $5 trillion in consumer spend that is transitioning in this way and growing every year.”

What Are Aggregators Looking For?

Hollywood has the Academy Awards. Broadway gives out the Tonys. When it comes to recognizing ecommerce sellers, Amazon offers up their Amazon Choice and Best Seller Badges. Aggregators use these as signposts to identify Amazon products that are worth a closer look.

But, what can you do?

The common wisdom says that getting your Amazon business READY to sell will benefit all ecommerce sellers. Whether you’re looking to sell or not, following this checklist will help make your overall Amazon business better and more sustainable in the long run.

Here’s how to do that:

1. Your brand should be registered with Amazon

Enrolling in Amazon Brand Registry unlocks a suite of Amazon tools designed to help you build and protect your brand. Sellers also need Amazon brand registry in order to trademark their products to help protect themselves from the risk of counterfeiters and knock offs.

2. You are selling through FBA, right?

Effortless shipping and logistics, discounted shipping rates, customer service management and returns, quick delivery, virtually unlimited (though sometimes pricey) storage, and omni-channel fulfillment. What’s not to like? Remember, aggregators are looking for a turn-key product. FBA (Fulfillment by Amazon) is made to order for aggregators.

3. Finding a perfect balance

For aggregators, there is a definite balance that they look for when it comes to the number of Amazon product SKUs that sellers have listed. They don’t want too many or too few products.

Amazon sellers that depend on a single (even highly profitable) product run big risks in the event that they run out of stock, have problems with their supply chain, hijackers or are suspended.

Two or three products with strong, consistent sales, and a good customer base is preferable to the same exact amount of revenue coming from twice the SKUs.

4. White hat sellers need only apply

Aggregators aren’t looking for any drama with Amazon. What they want is a stable, profitable business. Black hat tactics (paying for reviews, insider arrangements with corrupt Amazon employees, etc) are just bad for business.

5. 365 days of profitability

Amazon Aggregators aren’t really interested in chasing trends. They’re looking for products that target long-term, evergreen market interests. If you have a track record of substantially satisfying seasonal demand, smart aggregators have become increasingly ecommerce-aware and understand that the right seasonal product might sell in a month what others do in the rest of the year.

6. Use software to check under the hood of Amazon listings

Helium 10 has a Chrome extension that will help give you an insiders’ view into an Amazon product’s overall potential.

Want to identify where a brand is getting the bulk of its profits, there’s Xray. Wondering about freight and storage fees? Open Profitability Calculator. Review Insights gives you an idea if there are any red flags to be aware of.

You can also track BSR (Best Sellers Rank) to look for consistency of sales (and pricing) throughout the lifetime of the product.

Should Amazon Be Looking in Their Rearview Mirror?

TechCrunch recently hinted at the future of ecommerce when they wrote about a startup by the name of Fabric. What Fabric is doing is building technology to help retailers (of all sizes) compete with Amazon. By using robotics technology, Fabric is building “micro-fulfillment” centers and “last-mile” operations that are destined to shrink the technology gap between Amazon and those looking to duplicate Amazon’s success.

It’s hard not to imagine mega-aggregators viewing this as a stepping stone towards another level of expansion.

Fabric says in their advertising copy that, “With local inventory and micro-fulfillment centers, close to where your customers are, you can offer same-day delivery to drive revenue and customer loyalty.”

Sound familiar?

The ecommerce world is gradually being restructured to align with the business models adopted by increasingly sophisticated aggregators. Make sure that you are one of the Amazon sellers who will be rewarded for doing things the right way!

Now might be a very good time to put a nice shine on your Amazon product listings.

To do that, the first thing that you should do is reach out to the experts at CANOPY Management.

CANOPY Management’s team leverages experience from across all corners of the Amazon industry to help you scale your business and gain market share. This allows you to keep your hands on the wheel of your Amazon business while at the same time benefiting from the wealth of experience and expertise of the CANOPY Management team.

One thing that’s for sure, ecommerce is going to continue to grow and evolve. CANOPY will be here to make sure that you keep pace with the changes!